News: Is Your State Addicted to Tobacco Taxes?

15 Aug 2013

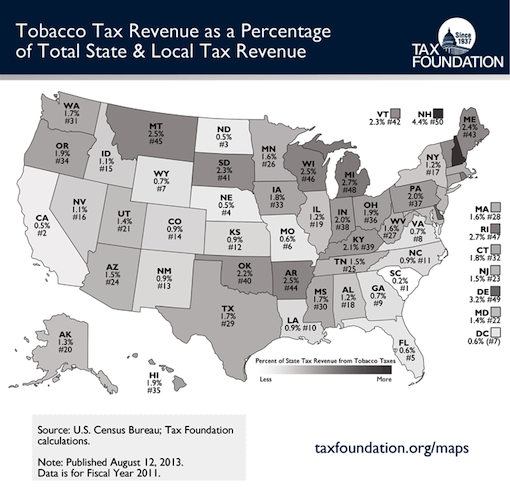

The non-partisan Tax Foundation has produced an interesting graphic showing what percentage of each states’ revenues comes from tobacco taxes. The data indicates higher tax rates don’t correlate to higher revenues for a particular state.

New Hampshire, with one of the lower tobacco tax rates, leads the country with 4.37% of state revenues being collected from tobacco taxes. New Hampshire has lower taxes than any of its regional neighbors: Maine, Vermont, Massachusetts, and Connecticut.

Meanwhile, none of the top 10 states for cigarette taxes (New York, Rhode Island, Hawaii, Washington, Connecticut, New Jersey, Wisconsin, Massachusetts, Vermont, and Arizona) are in the top 16 states when it comes to percentage of revenues produced by tobacco taxes.

Not surprisingly for those who follow these things, New Hampshire, with it’s low tax rates, has the lowest rate of cigarette smuggling in the country. New York, with the highest tax in the country, has the most cigarette smuggling.

Cigarettes are more of a pure commodity than cigars, but it’s worth noting higher taxes don’t necessarily mean higher revenues; they do mean more smuggling. These are important facts to raise if your state or locality is proposing to raise tobacco taxes (and cigarette tax rates are highly correlated to cigar tax rates).

The data also begs the question: If higher tobacco taxes don’t actually raise more revenues for the state, why raise tax rates? One possible answer is that politicians are trying to use taxes to control the actions of their citizens and make it unaffordable for adults to choose to smoke (though the data also suggests they are driving citizens to buy smuggled tobacco).

More fundamentally, the fact that tobacco taxes make up such a major part of so many state budgets should (but probably won’t) give anti-tobacco activists pause. After all, is it really wise for the state to be so dependent on tobacco taxes?

photo credit: Tax Foundation

It’s a new rum (officially launched last month in Washington, DC), but the team behind it is hardly inexperienced. Leading the charge is Jay Maltby, formerly an executive with Bacardi and Cruzan.  He is joined by Lincoln Henderson, longtime master distiller at Brown Forman (Woodford Reserve and Old Forrester) and currently the innovator behind Angel’s Envy, which has gained a loyal following for its

It’s a new rum (officially launched last month in Washington, DC), but the team behind it is hardly inexperienced. Leading the charge is Jay Maltby, formerly an executive with Bacardi and Cruzan.  He is joined by Lincoln Henderson, longtime master distiller at Brown Forman (Woodford Reserve and Old Forrester) and currently the innovator behind Angel’s Envy, which has gained a loyal following for its

At the time, I was given a pre-release sample which I

At the time, I was given a pre-release sample which I

That battle for humidor space is what the annual cigar convention is all about. Cigar makers trying to convince retailers to add more of their products. Retailers trying to decide what will sell best.

That battle for humidor space is what the annual cigar convention is all about. Cigar makers trying to convince retailers to add more of their products. Retailers trying to decide what will sell best. Patrick Ashby

Co-Founder & Editor in Chief

Patrick Ashby

Co-Founder & Editor in Chief Patrick Semmens

Co-Founder & Publisher

Patrick Semmens

Co-Founder & Publisher George Edmonson

Tampa Bureau Chief

George Edmonson

Tampa Bureau Chief