Commentary: Coming to Terms with Winter

17 Feb 2020

Think you love cigars? Let’s put your adoration to the test. Go out and smoke a cigar in the cold. And, no, I don’t mean 40 degrees. I said cold. Let’s put it at 20 degrees or less (not including windchill). Bundle up, plant yourself in a chair with a cup of hot (not for long) coffee, and fire up a smoke. If you’re sitting still—and if you’re not cheating with, say, a heat lamp or something—I bet you won’t be able to get through a toro. Maybe not even a robusto or a corona.

At some point in the process, you’ll find yourself pondering the futility of the exercise. Isn’t the whole idea behind cigars to enjoy yourself? How can you fully appreciate the enticing aromas, delicious flavors, and handmade craftsmanship when your core bodily processes are shutting down and frostbite is trying to take hold of exposed skin? How can you revel in the complexities of the profile—which surely includes anise, cream soda, and pencil shavings—as your shivering turns into slowed, shallow breathing and, eventually, total loss of consciousness?

Maybe you never have to ask yourself these questions. Perhaps you live somewhere where it never gets legitimately cold, at least not for a whole season. Or, if you do, perhaps you can smoke inside your home. Or there’s a good lounge nearby with decent hours. Or perhaps you commute via car and don’t mind smoking in your vehicle (side note: smoking a cigar while driving is not all it’s cracked up to be).

I used to have a cigar room in my condo in the city.. Now I have a bunch of kids and a house in the suburbs.

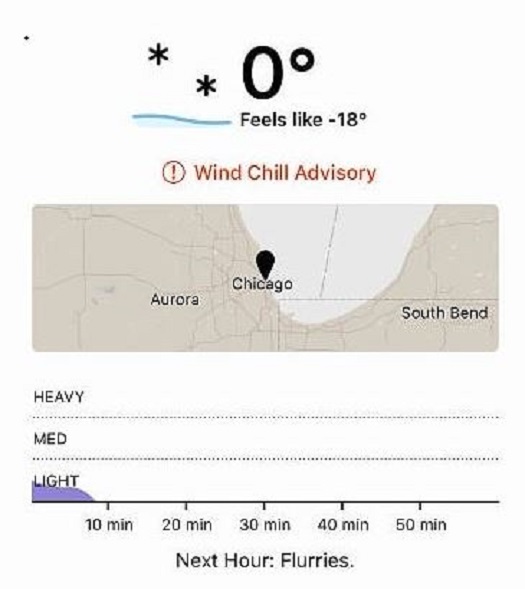

Personally, I live in Chicago. Winter can be rough, and this one is no exception. I have three small children and no place to smoke inside my home. There are a few lounges nearby, but the hours typically don’t work for me (it’s usually 10:30 PM or later by the time the kids are all asleep, the dishes are done, etc.). And, while I’m often on the “L†or on my way to an airport in an Uber, I’m rarely in my own car. So where and when do I smoke, you may ask?

Honestly, I smoke much, much less in the winter. I really don’t have a choice. It may not be fashionable for a member of the online cigar media to admit this, but it’s true nonetheless.

When I do smoke, it’s usually one of two things: (1) I’ve gotten permission from the wife to be at a lounge for a couple hours, which is a welcome respite that will have to be repaid in some (often painful) way, or (2) I’m traveling for work someplace warm and/or there’s a late-hours lounge nearby.

I write this not to ask for your sympathy (I don’t deserve any, and I’m not complaining) but to share a few unintended consequences of my wintertime lull in cigar smoking. First, when you smoke less, you enjoy the cigars you do smoke more. The law of diminishing returns is absolutely at play here. If you smoke cigar after cigar after cigar, the next one won’t be nearly as enjoyable. Anyone who’s ever gone on a cigar rampage—or taken a leave of absence—would probably back this up.

Second, having fewer opportunities to smoke results in a renewed focus on deciding what to smoke. Time is more precious, and the cost of making a bad decision is higher. In the winter, I’m likelier to turn to old favorites and shun new experiences. Any new cigar that gets selected is often the result of a fair amount of review-reading—or, at least, much more research than would be required in the summer.

Finally, less time to smoke should mean more time for something else. In my case, the inability to smoke as often as I would like has not extinguished my passion for cigars. So I’ve been catching up on cigar-related reading (both mainstream publications and, yes, other websites), making some purchases, organizing my inventory, and keeping the humidors functioning properly (which is no small task this time of year).

I guess you could say I’ve come to terms with a seasonal approach to cigar enjoyment. That being said, where the f*#k is spring, and when will it get here?

photo credit: Stogie Guys

It has been over five years (!) since the StogieGuys.com team published a new list of Gold Star Smokes. As you might recall, this special designation celebrates cigars we feel are worthy of extra-strong recommendations. They don’t necessarily have to be five stogie-rated—just commendable smokes we find ourselves turning to time and again.

It has been over five years (!) since the StogieGuys.com team published a new list of Gold Star Smokes. As you might recall, this special designation celebrates cigars we feel are worthy of extra-strong recommendations. They don’t necessarily have to be five stogie-rated—just commendable smokes we find ourselves turning to time and again.

Patrick Ashby

Co-Founder & Editor in Chief

Patrick Ashby

Co-Founder & Editor in Chief Patrick Semmens

Co-Founder & Publisher

Patrick Semmens

Co-Founder & Publisher George Edmonson

Tampa Bureau Chief

George Edmonson

Tampa Bureau Chief