News: Growing Evidence Suggests Tobacco May Play a ‘Protective’ Role Against Covid-19

27 Apr 2020

There is so much we don’t know about SARS-CoV-2, the Coronavirus currently threatening global health and the world economy. But perhaps one of the more surprising stories emerging from this massively disruptive virus is the growing evidence that tobacco use might be a factor in preventing transmission of Covid-19.

The cigar industry, like so many industries, has been massively impacted. Many factories have paused operations. In some states, cigar shops have been deemed “non-essential” and shut down, while elsewhere they continue to operate with new social distancing policies. Whether completely shut down or just limited, cigar shops are at serious risk of not surviving. Meanwhile, in response to the crisis, the federal government has delayed FDA filing and tobacco tax deadlines.

Early on as the virus was spreading, the assumption was smokers and former smokers (especially of cigarettes) were at higher risk of catching the virus, due to its transmission through the respiratory system. Anti-smoking activists were quick to cite the virus as a reason for more government policies limiting access of adults to tobacco. The World Health Organization made similar arguments.

Anti-smoking “zealot” Stanton A. Glantz (whose propensity to draw sweeping conclusions from limited statistics has been documented) even claimed, “the odds of disease progression (including to death) were 14 times higher among people with a history of smoking compared to those who did not smoke… the strongest risk factor among those examined.” That claim has since apparently been stealth edited out of the original article, but remains quoted in articles about it, including one specifically arguing Coronavirus meant it was time to quit cigars.

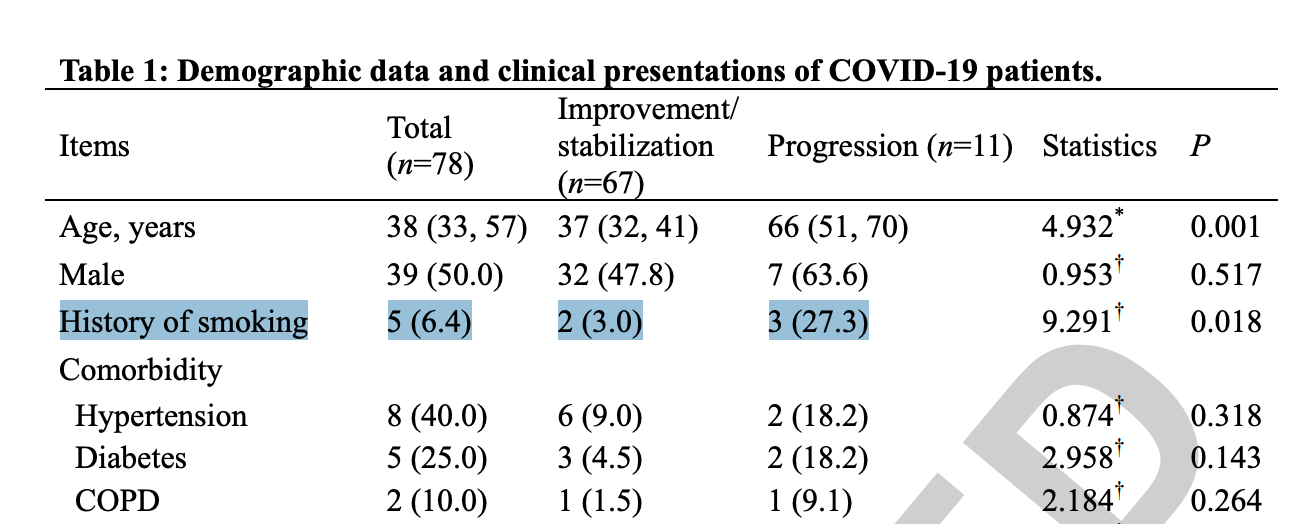

The since walked-back “14 times higher” claim (which was also pushed by the British Government) was actually based on a Chinese study with a sample size consisting of five total smokers (see above). This is a sample so small any serious scientist would never rely on it, certainly not to make such sweeping claims. Needless to say, those of us who have been following this issue for awhile aren’t surprised to find government agencies twisting statistics to push their anti-tobacco agenda.

Experts: Tobacco May Play a ‘Protective’ Role Against Covid-19

What is truly remarkable is the mounting evidence that smoking makes smokers (and, to a lesser extent, ex-smokers) specifically less susceptible to the virus. Contrary to the cherry-picked conclusions pushed by anti-tobacco activists, every week more evidence seems to emerge that bolsters the conclusion that tobacco protects smokers from Covid-19.

Author Christopher Snowdon (who has written books exposing the exaggerated claims of anti-smoking activists) recently summarized the ever-expanding evidence:

In [China] where 27 per cent of adults smoke, only 6.4 per cent of the Covid-19 cases were smokers. This was not a fluke finding. Awkwardly for the anti-smoking lobby, smokers have been strangely under-represented in all the studies for which smoking prevalence data is available. They made up just 1.4 per cent of the cases in Zhang et al, 6.7 per cent in Wan et al, 3.9 per cent in Mo et al, seven per cent in Huang et al, nine per cent in Dong et al, 10 per cent of cases in Yang et al, 1.9 per cent in Guan et al, six per cent in Zhou et al, and 6.4 per cent in Liu et al. In Shi et al, only 8.2 per cent of cases had any smoking history [current or former smokers].Â

Dr Konstantinos Farsalinos of the University of Patras in Greece noticed this phenomenon early on and put a preliminary study online in late March. It noted the ‘unusually low prevalence of current smoking was observed among hospitalised Covid-19 patients’, which ‘does not support the argument that current smoking is a risk factor for hospitalisation for Covid-19, and might suggest a protective role’.Â

A few days earlier, a group of doctors from the Royal Glamorgan Hospital had written to the British Medical Journal to point out that nicotine protects against the kind of acute inflammatory reactions seen in Covid patients and that ‘the simple use of nicotine patches should be urgently considered and discussed.’ Nobody paid much attention, but evidence supporting the smoking hypothesis continued to slip out.Â

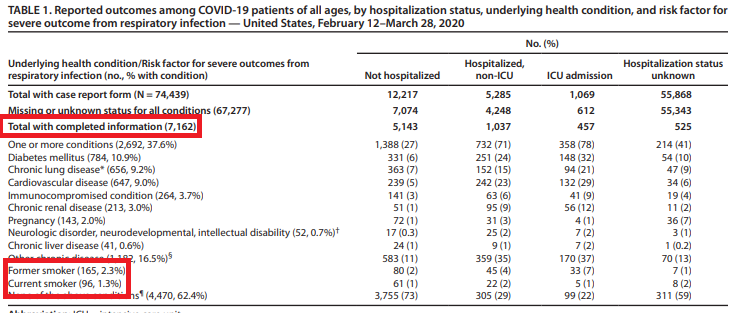

On 3 April, the U.S. Centers for Disease Control published data on thousands of American Covid-19 cases. Once again, the proportion of smokers was tiny – just 1.3 per cent [versus 14% who smoke]. Even ex-smokers were significantly under-represented (2.3 per cent).

The most comprehensive epidemiological study appeared a week later. Based on data from 4,103 Covid patients in New York City, a team of researchers found that a history of smoking was associated with a 29 per cent reduction in risk of being hospitalised with Covid-19 and, contrary to the claims of Public Health England, smokers were no more likely to become critically ill with the disease if they were admitted. The authors would have found an even sharper reduction in risk for current smokers if they had split them up from ex-smokers in their analysis, but even the findings as published were striking.Â

This week, a group of French academics published their study of 343 Covid patients, of whom only 4.4 per cent were daily smokers. According to the authors, the study ‘strongly suggests that daily smokers have a very much lower probability of developing symptomatic or severe SARS-CoV-2 infection as compared to the general population.’

Pause a second to consider some of those quotes from medical experts (emphasis added):

“[The study] strongly suggests that daily smokers have a very much lower probability of developing symptomatic or severe SARS-CoV-2 infection as compared to the general population.”

“[The] unusually low prevalence of current smoking was observed among hospitalised Covid-19 patients… does not support the argument that current smoking is a risk factor for hospitalisation for Covid-19, and might suggest a protective role.”

There are, of course, many unanswered questions about the reason for the apparent link between smoking and lower rates of symptomatic Covid-19. Still, it’s enough that French researchers have already initiated a study consisting of handing out nicotine patches to frontline medical workers and Coronavirus patients:

Nicotine could protect people from contracting the coronavirus, according to new research in France, where further trials are planned to test whether the substance could be used to prevent or treat the deadly illness. The findings come after researchers at a top Paris hospital examined 343 Coronavirus patients along with 139 people infected with the illness with milder symptoms.

They found that a low number of them smoked, compared to smoking rates of around 35 percent in France’s general population. “Among these patients, only five percent were smokers,” said Zahir Amoura, the study’s co-author and a professor of internal medicine.

The research echoed similar findings published in the New England Journal of Medicine last month that suggested that 12.6 percent of 1,000 people infected in China were smokers. That was a much lower figure than the number of regular smokers in China’s general population, about 26 percent, according to the World Health Organization (WHO).

The theory is that nicotine could adhere to cell receptors, therefore blocking the virus from entering cells and spreading in the body, according to renown neurobiologist Jean-Pierre Changeux from France’s Pasteur Institut, who also co-authored the study.

To be clear, we still know very little about Covid-19, which is part of the reason it remains such a serious threat. And as we scramble to treat it and prevent it, we know even less about the long-term impact of the deadly virus. (Certainly no medical experts are currently recommending people take up smoking to prevent Coronavirus.)

Among other considerations while digesting this data is that all tobacco use isn’t the same. Cigarettes are normally inhaled into the lungs, while cigars are not when used as intended. Any study of smokers or former smokers is statistically going to overwhelmingly be of cigarette smokers, not those who smoke the handmade cigars that are the longstanding focus at this website. And, of course, there are other risks associated with smoking (to differing degrees for different types of smokers), just as there are risks with any activity.

None of which diminishes the fact that it looks more and more likely that tobacco may be part of the solution, not part of the problem, when it comes to Coronavirus. In fact, one major tobacco company is already claiming to have found a tobacco-based breakthrough in the production of a Covid-19 vaccine.

The fact that the statistics are glaring enough that researchers are not only acknowledging smoking’s apparent preventative impact but are looking to nicotine to develop both preventative and treatment options, suggests this is not some random statistical anomaly.

–Patrick S

photo credit: Phil Kerpen/CMJ

Patrick Ashby

Co-Founder & Editor in Chief

Patrick Ashby

Co-Founder & Editor in Chief Patrick Semmens

Co-Founder & Publisher

Patrick Semmens

Co-Founder & Publisher George Edmonson

Tampa Bureau Chief

George Edmonson

Tampa Bureau Chief