News: New York State Cigar Tax Rates Increase, But Revenue Drops Dramaically

15 Jun 2011

Elected officials looking to raise cigar taxes to close budget deficits should look at New York State before proceeding. Despite two large tax increases, tax revenues from cigar taxes have fallen off dramatically.

In 2009, the state raised taxes in “Other Tobacco Products” (OTP) from 37% of the wholesale price to 46%. Then, in July 2010, the tax went up again to 75%—the highest in the nation. On top of its OTP tax, New York has a 4% state sales tax that is also applied to cigars and other tobacco products.

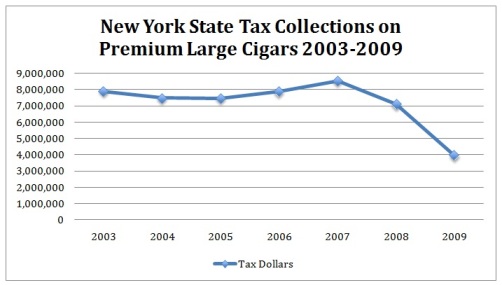

Meanwhile, taxes collected on premium handmade cigars have fallen over 50% from over $8 million per year in 2007 to about $4 million in 2009. The 2010 numbers aren’t available at this time, but Empire State retailers have observed continued declines.

As the graph above makes clear, New Yorkers have responded by dramatically cutting spending at their local cigar shops. New York’s neighbors have considerably lower OTP tax rates (Massachusetts 30%, Connecticut 27.5%, New Jersey 30%) or no OTP tax at all (Pennsylvania), and the New York Tobacconist Association, which is lobbying for a cap on the OTP tax, reports that customers are increasingly buying cigars from across state lines.

Analysis

While it would be easy to dismiss this as just another government failure to understand basic economics, I think there’s more at play here. The steep decline in tax revenues as a result in the dramatic tax increase should leave cigar smokers with two important takeaways.

First, the drop in tax revenues demonstrates why it is so vital for the entire cigar industry to oppose efforts to ban shipping cigars across states lines. Not only would such a ban prevent consumers from having a safety valve to escape oppressive taxes, but retailers in high tax states would lose one of the best arguments they have for keeping taxes down.

Currently, the New York Tobacconist Association is pushing for a tax cap, and while New York politicians may not be naturally friendly towards cigar rights or even the many small businesses negatively affected by the tax rate, they are always concerned about losing revenue, especially as many states face record budget shortfalls. Without a ban on shipping cigars in from other states, it is unambiguously clear that New York is losing tax revenues to its lower tax neighbors, giving government officials a strong incentive to pass a cap.

Second, cigar smokers need to consider that while increasing revenue is often given as the reason for tobacco tax hikes, the real reason may be more sinister. While politicians tasked with passing a balanced budget may bemoan the loss in state revenue, professional anti-tobacco activists see higher taxes as a form of social engineering.

Those who doubt that higher tobacco taxes are just a means by which anti-tobacco professionals seek to limit people’s free choices need look no further than the United Nation’s Orwellian-named “Tobacco Control” panel, which openly advocates “price hikes and smoking bans” as part of its “World No Tobacco Day” lobbying campaign. For these anti-tobacco zealots, higher taxes are merely a more publicly-palatable step towards outright tobacco prohibition.

photo credit: NYTA

Patrick Ashby

Co-Founder & Editor in Chief

Patrick Ashby

Co-Founder & Editor in Chief Patrick Semmens

Co-Founder & Publisher

Patrick Semmens

Co-Founder & Publisher George Edmonson

Tampa Bureau Chief

George Edmonson

Tampa Bureau Chief

Some on both sides of the aisle always view taxation as a means of social engineering. Get taxed more for one activity; get a tax break for engaging in some other activity. Bottom line: you tax higher those activities you wish to discourage.

It's time to refocus our taxation policies at all level on revenue generation instead of giving breaks to favored contributor groups or "desired" activities. As this would involve power being ripped out of the hands of politicians as a flat tax, FairTax, or consumption tax was put in place to replace our current tax system, I have my doubts as to if it can happen.

Best cigar prices.com is moving their entire operation to Pennsylvania because of New York greed. I hope someone in Albany gets their panties in a bunch when they fiqure how much money they will be losing.

Good to know, i didnot buy from them in the past because they would add NYS Tax to the total where as other PA firms do not