Commentary: Putting Cigar Industry Consolidation in Perspective

17 Sep 2014

On the heels of last week’s news that industry giant General Cigar had acquired the Toraño brands—and that Toraño would be shutting down—seemingly everyone had an opinion to voice. I saw viewpoints ranging from indifference to surprise to downright anger.

There remain many unanswered questions. Why did Toraño make this move now (assuming there is a reason beyond Charlie Toraño wanting to spend more time with his family)? Is General actually committed to maintaining the current Toraño portfolio as-is, or will there be changes to the existing blends? Will new Toraño offshoots/brands be launched by General? And what’s going to happen to Leccia Tobacco?

But whether or not you like this latest consolidation, it’s important to recognize this won’t be the last major deal joining brands that were once distinct. Longtime StogieGuys.com readers may recall several past articles where we’ve explained why:

“There are plenty of reasons to expect consolidation will continue to be a theme in the industry. Via economies of scale, larger companies can better adjust to the many tax and regulatory burdens that cigars now face. Combining sales forces and distribution channels can lower costs, keeping prices down for consumers while keeping profit margins healthy. Increased buying power also ensures access to the best tobacco available, as well as bigger advertising budgets.â€

Other motivations behind cigar industry consolidation (though not necessarily motivations behind General’s acquisition of Toraño, mind you) might include:

• Expanding geographical scope/reach

• Capturing new clients and more market share

• Acquiring technology, property, and recipes

• Reviving undervalued brands

• Diversifying the portfolio of offerings

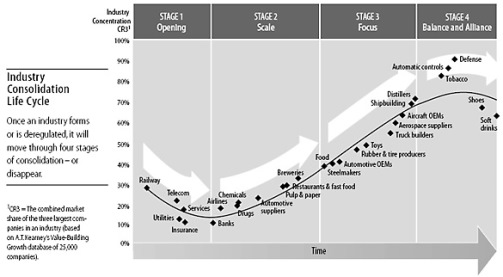

This article in the Harvard Business Review summarizes a study of 1,345 mergers over a 13-year period. It found, “once an industry forms or is deregulated, it will move through four stages of consolidation.†The result is an industry that is balanced and aligned. This final (fourth) state is defined as the top three companies claiming 70% to 90% of the market.

I’ll resist the temptation to try to identify which stage of the so-called “Consolidation Curve†the premium cigar industry currently occupies. If, as I suspect, it’s pre-stage four, we can expect more consolidation on the horizon—like it or not.

photo credit: Harvard Business Review

Patrick Ashby

Co-Founder & Editor in Chief

Patrick Ashby

Co-Founder & Editor in Chief Patrick Semmens

Co-Founder & Publisher

Patrick Semmens

Co-Founder & Publisher George Edmonson

Tampa Bureau Chief

George Edmonson

Tampa Bureau Chief

One of the oddities of cigar industry consolidation is that is often leads to more competition in the long run. Look at two of General Cigars recent purchases… CAO and LGC. Without those purchases you wouldn't have the startups Crowned Heads and EPC.

I'm not saying I've heard Charlie Torano will be back once whatever noncompete (assuming there is one) he might have signed runs out, but he'd hardly be the first person use the proceeds of the sale of an established company to start another company in the same industry.

Patrick – You can also add Christian Eiroa to that list. It reminds me a little of the tech industry, where the same thing often happens. In both, it's primarily intellectual capital that's valuable because it's relatively easy to contract out production, as opposed to an industry like autos or steel where production capacity is paramount.

I assume this is the only cigar blog linking to Harvard Business Review, at least today… 🙂