Stogie News: Camacho Cigars Purchased by Davidoff

14 Oct 2008

Continuing the cigar industry trend towards consolidation, the Oettinger Davidoff Group acquired Camacho Cigars on October 1. The deal was announced today, but monetary terms have not been disclosed at this time.

Davidoff will acquire all of Camacho’s brands plus its Honduran facilities, including Camacho’s factory in Danli, Honduras, and its tobacco-growing estates in the Jamastran Valley. According to a press release, Davidoff will keep Camacho’s 534 employees in Honduras and its 27 U.S.-based employees.

Camacho Cigars’ portfolio of ten brands includes Camacho, Baccarat ”The Game,” La Fontana, Legend-Ario, National Brand, Repeater, Deluxe, Don Macho, Don Felo, and Nude Bundles. We have extensively reviewed Camacho’s cigars, including the Candela Monarca, Corojo Churchill, Coyolar Puro Torpedo, Select Robusto, and the Triple Maduro Figurado.

Camacho Cigars’ portfolio of ten brands includes Camacho, Baccarat ”The Game,” La Fontana, Legend-Ario, National Brand, Repeater, Deluxe, Don Macho, Don Felo, and Nude Bundles. We have extensively reviewed Camacho’s cigars, including the Candela Monarca, Corojo Churchill, Coyolar Puro Torpedo, Select Robusto, and the Triple Maduro Figurado.

Oettinger Davidoff produced 30.8 million cigars in 2007 and has 3,344 employees worldwide. Its brands include Davidoff, Zino, AVO, Griffin’s, Private Stock, and Winston Churchill.

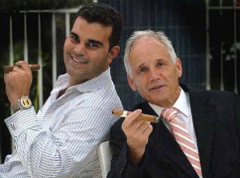

Dr. Reto Cina, CEO of the Oettinger Davidoff Group, described the aquisition: “With the addition of Camacho Cigars and Mr. Christian Eiroa, the Oettinger Davidoff Group has successfully united two families with a passion for cigars as a Premium Product and the ambition to strive unceasingly for the highest quality standards.â€

Analysis

This deal makes sense on many levels for Davidoff. They acquire a solid and growing brand in Camacho which can be sold to the non-U.S. market (where Oettinger Davidoff is a market leader), including duty-free shops where 22% of Davidoff’s cigars are sold.

The deal also diversifies Davidoff’s cigar portfolio in two important ways. First, many of Camacho’s cigars are priced downmarket of Davidoff’s super-premium Davidoff, AVO, and Zino brands, giving the company a wider range of cigars at a more diverse range of pricepoints.

Additionally, the move diversifies Davidoff’s cigar production, meaning a hurricane or other natural disaster cannot wipe out the company’s entire growing capacity (currently based in the Dominican Republic). The larger market share may also increase Davidoff’s access to the best tobacco, which is becoming increasingly expensive and difficult to obtain.

On a larger scale, this acquisition continues a trend of industry consolidation. In addition to cigar makers buying other cigar makers, a big trend has been vertical consolidation where companies make acquisitions to control not only tobacco production and cigar making, but also distribution and retail sales. Faced with increasing tobacco taxes and smoking bans, plus possible FDA regulation that may require increased compliance costs, companies are combining to become leaner and more efficient.

Photo Credit: Miami Herald

Patrick Ashby

Co-Founder & Editor in Chief

Patrick Ashby

Co-Founder & Editor in Chief Patrick Semmens

Co-Founder & Publisher

Patrick Semmens

Co-Founder & Publisher George Edmonson

Tampa Bureau Chief

George Edmonson

Tampa Bureau Chief

A couple of other interesting points: Julio Eiroa, who founded Camacho in 1987, will retire from cigar operations and focus on growing tobacco. And how many readers could correctly name Camacho’s top-selling cigar? It’s the totally unheralded Baccarat Rothschild robusto!

Interesting analysis… I feel like I'm reading the Wall Street Journal