Stogie Commentary: Questions for the Future

2 Apr 2009

With the economy still struggling and the SCHIP taxes taking effect this week, I’ve been thinking what the future might hold for the cigar industry. Here are a few of the questions I have:

1. Will General and Altadis move to increase their market shares? The two giants already control a large share of the market and have expanded their reach in recent years to include huge retailers, a magazine, distributors, and who knows what else. I would be flabbergasted if we don’t see more buyouts, especially of boutique manufacturers.

1. Will General and Altadis move to increase their market shares? The two giants already control a large share of the market and have expanded their reach in recent years to include huge retailers, a magazine, distributors, and who knows what else. I would be flabbergasted if we don’t see more buyouts, especially of boutique manufacturers.

2. Will more states seek revenue by collecting sales taxes from online transactions? This, too, seems likely. Cigars are a miniscule component, but such a move would probably serve the interests of B&Ms, who’ve always had to collect the money.

3. Will Florida and Pennsylvania impose taxes on cigars and will low-tax states ratify increases? Taxes in Pennsylvania and Florida—both of which are considering taxes—would have an extraordinary impact on major online operations, as would boosts by low-tax states, such as North Carolina. Just think of how many operations are in those states (Cigars International, Famous Smoke Shop, JR Cigars, Holts, Thompson). Again, this would at least somewhat level the playing field for local shops and Internet sellers, but the end result would be higher prices for consumers.

4. Will cigar makers begin to pare back? Fancy boxes and intricate bands would be my candidates for extinction as costs go up. More limited editions could supplant introductions of new lines because of the need for less inventory.

5. Will the industry and its related organizations work to change the image of cigar smokers? The perception that cigar smokers are $10,000-watch-wearing, first-class-flying, Wall-Street-worshiping, wine-sipping snobs makes it easy to single them out for taxes. Getting out the truth about the vast majority of people who actually enjoy cigars would certainly help.

photo credit: WordPress

My quick observations today, however, are far more subjective. I don’t claim to have the answer because, more than likely, there is no one good solution. If anything, I’m hoping to open a dialogue in which I would encourage you all to participate.

My quick observations today, however, are far more subjective. I don’t claim to have the answer because, more than likely, there is no one good solution. If anything, I’m hoping to open a dialogue in which I would encourage you all to participate. One recent example is a study that found exposure to secondhand smoke could double the likelihood of suffering from depression. Could be. Does it matter? Maybe, maybe not. It’s impossible to tell without a reference point, such as the general rate for depression.

One recent example is a study that found exposure to secondhand smoke could double the likelihood of suffering from depression. Could be. Does it matter? Maybe, maybe not. It’s impossible to tell without a reference point, such as the general rate for depression. 1. If you are the sort of occasional smoker who chooses a good cigar when you have the time and place to enjoy it, it can be difficult to save money without sacrificing some pleasure. (Unless, of course, you’re routinely toasting $20-$30 cigars, in which case you probably don‘t need my advice.) I think your best bet is to try to identify what it is you like most about your current sticks and see if there is a lower-priced line that’s close. Some of the smaller brands, such as Oliva, Alec Bradley, Camacho, and Toraño, have good, cheaper offerings.

1. If you are the sort of occasional smoker who chooses a good cigar when you have the time and place to enjoy it, it can be difficult to save money without sacrificing some pleasure. (Unless, of course, you’re routinely toasting $20-$30 cigars, in which case you probably don‘t need my advice.) I think your best bet is to try to identify what it is you like most about your current sticks and see if there is a lower-priced line that’s close. Some of the smaller brands, such as Oliva, Alec Bradley, Camacho, and Toraño, have good, cheaper offerings. Fortunately, that model already exists. Perhaps not surprisingly (because many aspects of cigar culture are already borrowed from wine) that model is wine. The popular ratings systems we’re accustomed to were adapted from wine ratings, as was much of the terminology that we use to describe how cigars taste and smell.

Fortunately, that model already exists. Perhaps not surprisingly (because many aspects of cigar culture are already borrowed from wine) that model is wine. The popular ratings systems we’re accustomed to were adapted from wine ratings, as was much of the terminology that we use to describe how cigars taste and smell. Well, maybe that’s a reach. But, at the very least, we’re bound to come across a few worthy tales from occasional smokers and full-blown cigar enthusiasts alike. In that spirit, and even though the tot in this dated photo surely has a more interesting story than any of ours, here’s how (and approximately when) each StogieGuys.com team member got their start.

Well, maybe that’s a reach. But, at the very least, we’re bound to come across a few worthy tales from occasional smokers and full-blown cigar enthusiasts alike. In that spirit, and even though the tot in this dated photo surely has a more interesting story than any of ours, here’s how (and approximately when) each StogieGuys.com team member got their start. Often they flap their hands around, pretending to cough as they wave smoke from their face. On rarer occasions they will confront you to loudly proclaim, “That stinks! Can’t you put it out?” They might even laughably suggest you are killing them or giving them lung cancer by smoking nearby.

Often they flap their hands around, pretending to cough as they wave smoke from their face. On rarer occasions they will confront you to loudly proclaim, “That stinks! Can’t you put it out?” They might even laughably suggest you are killing them or giving them lung cancer by smoking nearby. Patrick Ashby

Co-Founder & Editor in Chief

Patrick Ashby

Co-Founder & Editor in Chief Patrick Semmens

Co-Founder & Publisher

Patrick Semmens

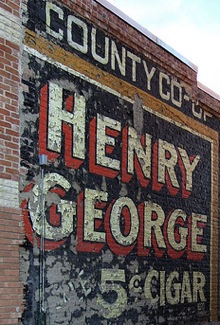

Co-Founder & Publisher George Edmonson

Tampa Bureau Chief

George Edmonson

Tampa Bureau Chief