News: Obama Budget Proposes 94% Tobacco Tax Hike

6 Mar 2014

When he was running for president in 2008, Senator Obama promised not to raise “any taxes” on families making less than $250,000. Fifteen days after being sworn into office, he broke that pledge by signing the SCHIP bill that included a major increase in federal tobacco taxes.

Now, five years into his presidency, Obama (himself a longtime cigarette smoker) has proposed raising taxes further. His proposed budget for fiscal year 2015 includes a 94% increase in tobacco taxes.

Now, five years into his presidency, Obama (himself a longtime cigarette smoker) has proposed raising taxes further. His proposed budget for fiscal year 2015 includes a 94% increase in tobacco taxes.

For cigarettes, the federal rate would jump from $1.01 to $1.95 per pack, up from 39 cents per pack in 2008. The new excise tax rates would then be increased annually to account for inflation. The rate on cigars, which is a percentage of sales as opposed to a per-unit tax, would increase proportionally, presumably with the tax cap jumping from 40 cents per cigar to upwards of 75 cents.

According to an IPCPR statement, in FY2015 the proposed tax hike is estimated to raise $78.217 million over 10 years, which the budget says would be used to fund pre-K education.

Analysis

Fortunately, this budget has pretty much zero chance of passing in its current form. As the IPCPR notes in its statement, “IPCPR does not expect this proposal to be approved by the Republican-controlled House of Representatives, but it does demonstrate that the entire suite of tobacco products is going to be on the table when legislators are searching for revenue to fund unrelated programs.”

And that is exactly the key takeaway. President Obama has repeatedly promised that tax hikes wouldn’t impact anyone not in the highest income percentiles. But, like so many areas, there’s an unwritten asterisk when it comes to tobacco.

Tobacco taxes disproportionately impact lower income income Americans, and that doesn’t include the lower income people in other countries who would lose their jobs as consumption is reduced by the high prices of increasingly climbing taxes. Yet, even a president who says he only wants to target the wealthiest Americans with higher taxes feels free to target those with lower incomes if they smoke.

Ultimately, the key point is that cigar smokers (and other tobacco users) need to make it clear to their elected officials that they are taxed enough already. If something (whether it be pre-K education or anything else) is worth paying more taxes for, then they should seek to pay for it out of taxes that impact everyone, not taxes targeted at a minority that already pays more their than their fare share.

photo credit: Lisa Jack

Answers came in the form of

Answers came in the form of

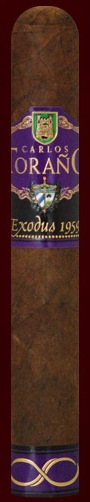

The Toraño Family Cigar Co. doesn’t usually turn out puros. The company has long been known for its blending, combining tobacco from numerous countries. The flagship Exodus 1959 Gold, for example, is almost a mini-United Nations, sporting leaves from five countries.

The Toraño Family Cigar Co. doesn’t usually turn out puros. The company has long been known for its blending, combining tobacco from numerous countries. The flagship Exodus 1959 Gold, for example, is almost a mini-United Nations, sporting leaves from five countries.

1) Arguably the most celebrated family in the cigar industry today has announced a new cigar that’s slated for release before the end of 2014. The Garcias, including patriarch Don PepÃn Garcia (pictured), are planning a line called La Antiguedad (Spanish for “the antiquityâ€). It will feature an Ecuadorian Habano wrapper around double binders (Nicaraguan Criollo and Nicaraguan Corojo). The filler tobaccos will also be Nicaraguan, and it will be made at the heralded My Father Cigars factory. All five sizes will be box-pressed and the prices will range from $6 to $10.

1) Arguably the most celebrated family in the cigar industry today has announced a new cigar that’s slated for release before the end of 2014. The Garcias, including patriarch Don PepÃn Garcia (pictured), are planning a line called La Antiguedad (Spanish for “the antiquityâ€). It will feature an Ecuadorian Habano wrapper around double binders (Nicaraguan Criollo and Nicaraguan Corojo). The filler tobaccos will also be Nicaraguan, and it will be made at the heralded My Father Cigars factory. All five sizes will be box-pressed and the prices will range from $6 to $10. Patrick Ashby

Co-Founder & Editor in Chief

Patrick Ashby

Co-Founder & Editor in Chief Patrick Semmens

Co-Founder & Publisher

Patrick Semmens

Co-Founder & Publisher George Edmonson

Tampa Bureau Chief

George Edmonson

Tampa Bureau Chief