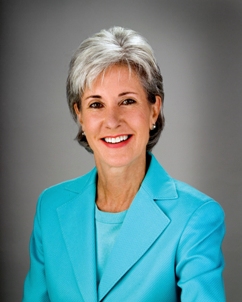

Stogie News: Obama Picks Anti-Tobacco Governor for HHS

4 Mar 2009

President Obama this week named Kansas Governor Kathleen Sebelius as his choice to head the U.S. Department of Health and Human Services. She was picked after the president’s original nominee, former Senator Tom Daschle, withdrew his nomination after it was revealed that he failed to pay over $120,00 in taxes.

Sebelius has a record for pushing both smoking bans and tobacco tax hikes and, while neither has gone into effect yet in Kansas, her attempts to impose a draconian statewide smoking ban are ongoing. The proposed smoking ban would include all bars and restaurants, and also restrict smoking outside near doors, windows, or “air intakes.”

Sebelius has a record for pushing both smoking bans and tobacco tax hikes and, while neither has gone into effect yet in Kansas, her attempts to impose a draconian statewide smoking ban are ongoing. The proposed smoking ban would include all bars and restaurants, and also restrict smoking outside near doors, windows, or “air intakes.”

In an editorial interview with the Wichita Eagle, Sebelius praised smoking bans and tobacco taxes, saying they “absolutely cost nothing.” She clearly fails to recognize the heavy burden of tobacco taxes, especially on lower income citizens, and she also ignores the infringements on personal choice and property rights that result from smoking bans. She called tobacco taxes “win-win” in the same interview and criticized efforts to add exemptions to the proposed smoking ban.

Statements like those have drawn fire from cigar choice advocates like Chris McCalla, legislative director of the International Premium Cigar & Pipe Retailers Association. “Based on impartial data generated by the Bureau of Labor Statistics, the Federal Reserve Bank has found that significant employment declines result from forced smoking bans, especially in bars and restaurants,” he said. “That means businesses die, workers lose their jobs, and the state and nation lose federal, state, and local tax revenues.”

McCalla went on to say that the constitutional rights of business owners are at stake when governments impose smoking bans on private property. “The marketplace has been very effective deciding which businesses elect to allow smoking or not. That’s as it should be: up to the individual business owner. For government to control private businesses is depriving citizens of the rights given to them by the U.S. Constitution.â€

If confirmed as secretary of Health and Human Services, Sebelius would be in a position to oversee national health policy and impose her anti-tobacco positions on the entire country.

photo credit: Wikimedia Commons

Now if the tobacco industry was presenting study after study that concluded that we need fewer smoking bans and lower tobacco taxes, you can bet that reporters and politicians wouldn’t blindly believe their claims. When the anti-tobacco industry has a study that agrees with their anti-tobacco agenda, however, the results are dutifully reported as scientific fact

Now if the tobacco industry was presenting study after study that concluded that we need fewer smoking bans and lower tobacco taxes, you can bet that reporters and politicians wouldn’t blindly believe their claims. When the anti-tobacco industry has a study that agrees with their anti-tobacco agenda, however, the results are dutifully reported as scientific fact  “The Freedom to Travel to Cuba Act, introduced Feb. 4 and referred to the Foreign Relations Committee, prohibits the U.S. president from regulating or prohibiting travel to or from Cuba by U.S. residents, except in times of war between the two countries or of imminent danger to public health or the safety of U.S. travelers.â€

“The Freedom to Travel to Cuba Act, introduced Feb. 4 and referred to the Foreign Relations Committee, prohibits the U.S. president from regulating or prohibiting travel to or from Cuba by U.S. residents, except in times of war between the two countries or of imminent danger to public health or the safety of U.S. travelers.â€ I discovered some of tobacco’s benefits when a letter from Dr. William Campbell Douglass II came across my desk this week. Once voted “Doctor of the Year†by the National Health Federation,

I discovered some of tobacco’s benefits when a letter from Dr. William Campbell Douglass II came across my desk this week. Once voted “Doctor of the Year†by the National Health Federation,  According to Patel, some cigar producers that make both handmade and machine-made cigars, including industry giant Altadis, were willing to accept higher taxes on handmade cigars if it meant lower taxes on their cheaper, higher-volume, machine-made cigars. In his exclusive interview, Patel indicated a tax cap of 20 cents per large cigar or less (as opposed to the currently proposed 40.27 cents) would have been possible if not for resistance from those who sell machine-made cigars.

According to Patel, some cigar producers that make both handmade and machine-made cigars, including industry giant Altadis, were willing to accept higher taxes on handmade cigars if it meant lower taxes on their cheaper, higher-volume, machine-made cigars. In his exclusive interview, Patel indicated a tax cap of 20 cents per large cigar or less (as opposed to the currently proposed 40.27 cents) would have been possible if not for resistance from those who sell machine-made cigars. Federal budget crunchers were working the numbers Monday, trying to see if everything adds up. Apparently, the increased tax revenue—largely from a cigarette tax boost—isn’t now sufficient to expand and fund a five-year plan. So, there’s consideration of shortening the time frame and coming back again in a few years.

Federal budget crunchers were working the numbers Monday, trying to see if everything adds up. Apparently, the increased tax revenue—largely from a cigarette tax boost—isn’t now sufficient to expand and fund a five-year plan. So, there’s consideration of shortening the time frame and coming back again in a few years.

Patrick Ashby

Co-Founder & Editor in Chief

Patrick Ashby

Co-Founder & Editor in Chief Patrick Semmens

Co-Founder & Publisher

Patrick Semmens

Co-Founder & Publisher George Edmonson

Tampa Bureau Chief

George Edmonson

Tampa Bureau Chief